[ad_1]

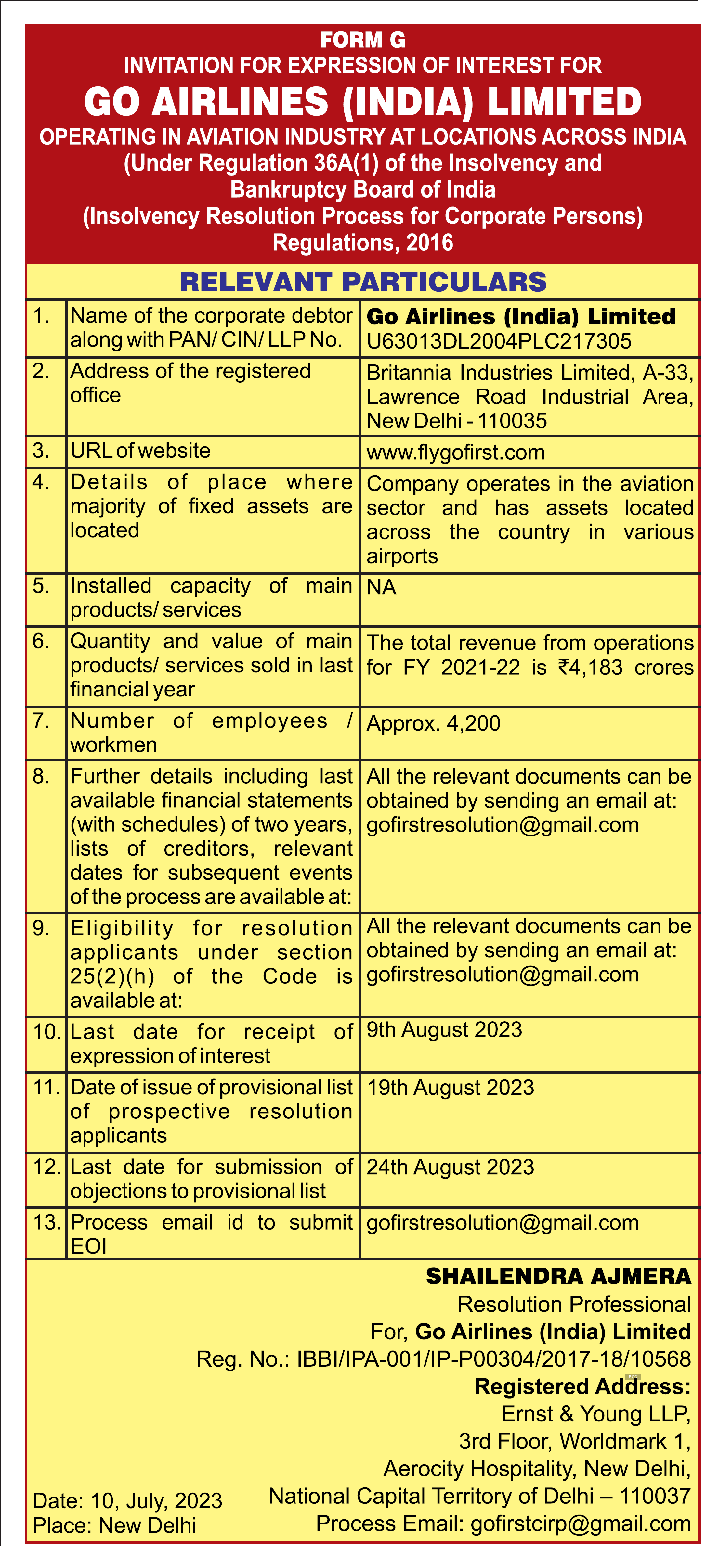

A resolution professional appointed to oversee the insolvency process for Go Airlines (India) Ltd has invited Expression of Interest for the sale of the carrier as part of the process, an advertisement in ET showed on Monday.

According to the advertisement, the last date for receipt of interest for the airline is set for August 9.

The EoI process means the formal commencement of seeking buyers, or investors, for a potential investment, as required by Indian law.

The airline company had filed for bankruptcy protection in May blaming “faulty” Pratt & Whitney engines for the grounding of about half its 54 Airbus A320neo planes.

The engine company, on its part, had said that the airlines claims were without merit.

According to regulations, the issuance and publication of the Form G – related to the invitation for EoI – would be the “prescribed next – step for taking the insolvency to its logical conclusion,” said news agency Reuters reported quoting Abhirup Dasgupta, a partner at HSA Advocates.

Meanwhile, lenders have raised concern over the order of the Delhi HC that restricts the airline from removing any parts from the aircraft it intends to fly.

The lessors own the aircraft but are now stuck as NCLT has imposed a ban on recovering the aircraft due to the ongoing IBC process.

The committee of creditors had earlier okayed funding of Rs 425 crore. They, however, are worried that such a requirement will be a hindrance to do business.

On Friday, resolution professional Shailendra Ajmera filed an appeal in the Delhi High Court challenging the order.The airline, branded Go First, stopped flying and appealed for insolvency proceedings in the National Company Law Tribunal (NCLT) on May 2 due to cash problems and after it had to ground more than half of its 54 planes because of supply issues from the American engine maker.

The grounded airline owes creditors, led by the Central Bank of India, more than Rs 6,500 crore. Central Bank has Rs 1,987 crore of outstanding loans, including about Rs 650 crore of post-Covid emergency lines.

ET had reported last week that an order from the Singapore arbitration court expected later this month would be key to Go First’s survival.

If the court does not grant Go First relief and direct Pratt & Whitney (P&W) to replace faulty engines, the airline cannot fly, possibly putting the whole recovery process into jeopardy, people familiar with the process told the newspaper.

While the Singapore International Arbitration award had directed P&W to dispatch around 20 engines by December 2023, the engine maker had subsequently challenged it citing payment failure by the airline and the ongoing global supply chain shortage. In its petition which was reviewed by ET, P&W has claimed that the airline owes it over $100 million.

A person aware of Go First’s business plan said that current trends show that a minimum of six engines could fail by November 2023.

Source link