[ad_1]

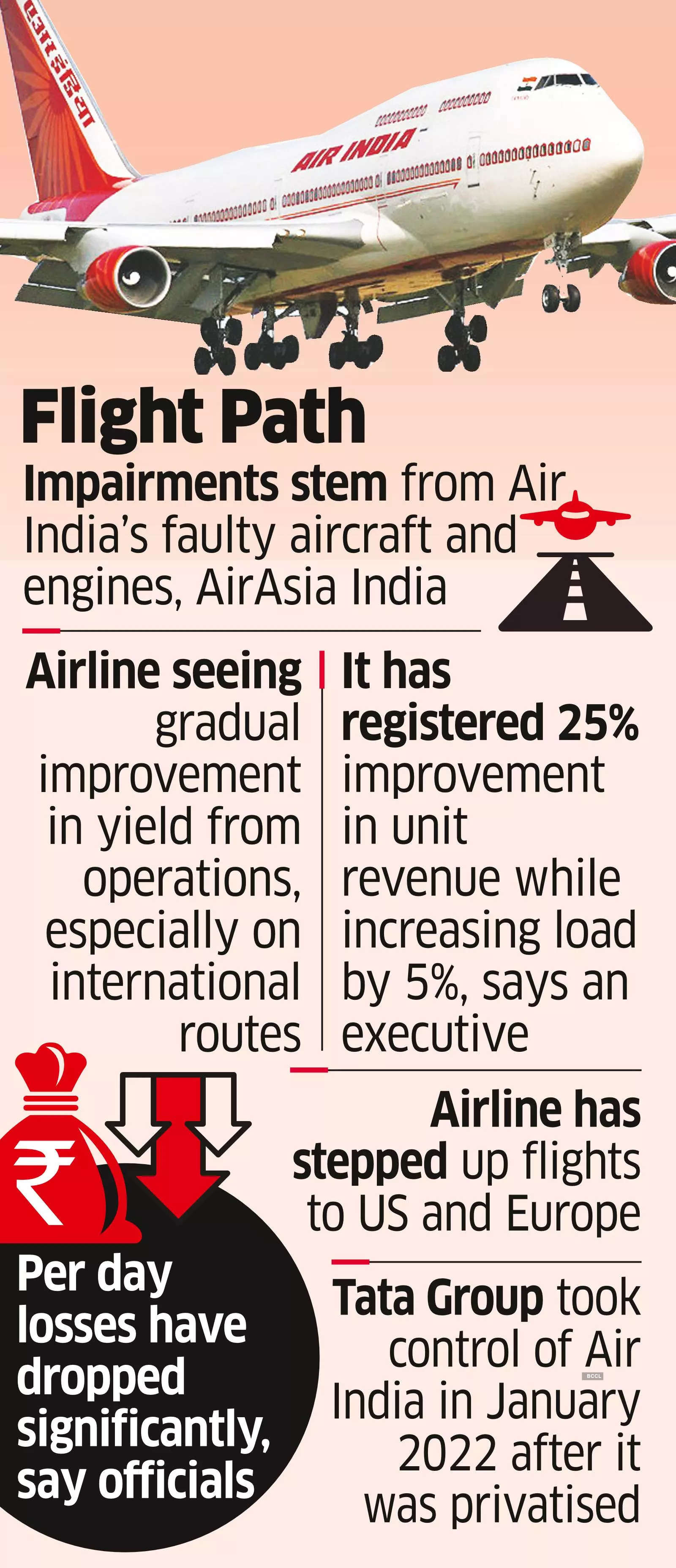

Tata-owned Air India wrote off an estimated INR 7,000 crore in FY23 as part of impairments stemming from the carrier’s faulty aircraft and engines as well as low-cost airline AirAsia India, people aware of the matter said. Losses shrank and the carrier was ebitdar (earnings before interest, taxes, depreciation, amortisation and restructuring or rent costs) positive, or profitable at an operating level, executives said.

“The airline (Air India), along with its subsidiary Air India Express, was ebitdar positive in FY23 and near breakeven after paying lease rentals in the first year, excluding AirAsia India, where most of the losses were recorded,” said a person aware of the development, pegging the net loss at slightly over INR 2,500 crore. This compares with a loss of INR 9,556 crore in FY22, the person said.

Air India accounted for a significant proportion of the AirAsia India write-off while former joint venture partner AirAsia Bhd picked up the rest, they said.

But for the write-offs, Air India’s financials in the year ended March were healthy as the new management focuses on operational efficiencies and cost savings, executives said. An impairment cost upward of INR 1,500 crore is estimated against AirAsia India and around INR 5,000 crore due to Air India’s old planes and engines.The Tata Group took control of Air India in January 2022 after it was privatised. The group is in the process of consolidating its aviation units. Air India Express is being merged with AirAsia India and Vistara with Air India.

“The airline needed a lot of restructuring and hence such a quantum of loss shows the plan is showing results,” he said.

‘Steady focus on costs, safety’

A positive ebitdar means the company is profitable at an operating level, excluding expenses such as taxes, rent and restructuring costs, officials said.

Air India did not reply to queries.

Top executives said the airline has kept a steady focus on both costs as well as safety, both of paramount importance.

“Many aircraft will be auctioned off or junked, keeping the safety aspect as top focus,” said the executive. “Sometimes, things may not be visible on the ground but Air India is focused on modernisation of its aircraft and systems and will make no compromises as far as safety is concerned, even as we cut costs through tech-led modernisation.” Air India has a number of grounded aircraft for which it pays lease rental without generating revenue. The airline has budgeted USD 400 million to revive and refurbish old aircraft.

The airline had posted a net loss of INR 9,556.5 crore on net revenue of INR 19,815.9 crore in FY22 on a standalone basis. In FY21, it had reported a net loss of INR 7,017.4 crore on revenue of INR 12,104 crore. Revenue figures for FY23 weren’t immediately available.

Tata Sons has taken multiple steps to improve revenue generation and bring down costs.

Air India CEO Campbell Wilson, who has been given a mandate to transform the airline, is creating a new operational structure. The airline is fixing systems and processes to ensure on-ground efficiencies besides keeping close tabs on daily losses. Wilson has been tasked with creating a customer-centric and service-oriented culture.

There is a gradual improvement in yield from operations, especially on international routes, with an upswing in both domestic and global travel. An executive said that the airline has registered 25% improvement in unit revenue while increasing load by 5%.

“The airline has been able to fill up aircraft despite charging high fares, which implies significant improvement in revenue performance,” said a person aware of the matter. “While before privatisation Air India was earning ₹70 crore per day, it earns INR 100 crore per day now even with lower capacity.”

[ad_2]

Source link