[ad_1]

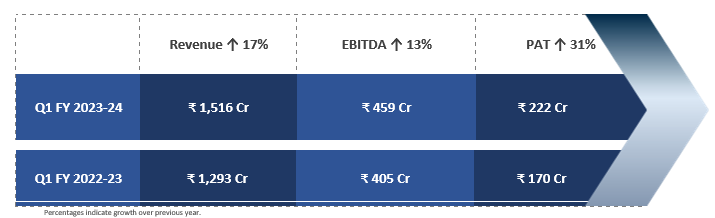

Country’s largest hospitality company, The Indian Hotels Company Limited (IHCL) reported its consolidated financials for the first quarter ending June 30, 2023. The company ended the first quarter with a strong performance led by double-digit revenue growth. Turnover crossed the INR 1,500 crore mark, making it a historical Q1 for IHCL which owns brands like Taj, Vivanta and SeleQtions among others.

Commenting on the Q1 FY24 performance, Puneet Chhatwal, Managing Director & CEO, IHCL, said, “Maintaining our industry-leading portfolio, IHCL signed 11 and opened 5 new hotels across all its brands. With our vast footprint across 125+ locations we will leverage the buoyancy in India’s travel and tourism sector. The outlook for the upcoming quarters remains strong with pace of demand driven by domestic consumption momentum, global events, and revival of international arrivals.”

Demand buoyancy in the IHCL’s international portfolio led to an occupancy of 65 per cent, which is an 11 per cent expansion over the previous year. On the back of IHCL’s asset-light strategy Management Fee income has grown by 20 per cent over the previous year.

The company signed 11 hotels during the quarter including a 400-room hotel in Delhi and a 120-room hotel in Kochi and entered new markets like Raichak in West Bengal and Dhaka in Bangladesh. IHCL opened 5 new hotels in the quarter taking the total operating hotels to 191 across brands.

Comapany’s air catering business TajSATS clocked a 55 per cent growth in revenue at INR 205 crores while the homestay and vacation home brand amã Stays & Trails’ portfolio crossed 125+ bungalows across 50+ holiday destinations.

Giridhar Sanjeevi, Executive Vice President and Chief Financial Officer, IHCL said, “A strong focus on profitability and cash flow resulted in IHCL Consolidated reporting a steady EBITDA margin of 30.3 per cent and net cash of INR 889 crores as on June 30, 2023. In Q1, we have commenced capital investments towards renovation and upgradation of select hotels in our portfolio.”

Taj was rated as India’s Strongest Brand 2023 across sectors and industries by Brand Finance, marking it the third time the brand has achieved this distinction.

[ad_2]

Source link