[ad_1]

US airlines are enjoying strong leisure travel demand, but corporate travellers are still not back in full force, compelling airlines to restructure their networks to account for fewer people flying for business purposes.

Before the pandemic hit in 2020, corporate travel was the travel industry’s cash cow. But now, with US companies still seeking to persuade employees to return to offices, bookings have stagnated. Investors in travel companies are concerned that the spending from vacationers cannot make up the shortfall.

Business trips generated as much as half of passenger revenue at US airlines before the global health crisis, according to industry group Airlines for America. This helped airlines sell high-margin premium seats and fill weekday flights.

For months, Alaska Air’s business bookings have been 25% below pre-pandemic levels. The Seattle-based carrier said it is hopeful of finally breaking through “the 75% recovered ceiling” next year when companies finalise new travel budgets, but it is wary of factoring that assumption into network planning.

“We are still waiting for the market to fully normalise,” Alaska Air’s chief financial officer, Shane Tackett, told Reuters. The company has been investing in leisure destinations like Mexico and Costa Rica, while its network in California remains 25% below 2019 levels. JetBlue Airways said on Tuesday it will redeploy capacity away from New York to high-margin leisure destinations with business travel demand 20% below pre-pandemic levels.

Southwest Airlines is shifting the frequency of its flights from mostly short-haul business routes to medium- and long-haul routes. It will also move flights from early morning or late-night hours and cut flights on Tuesdays and Wednesdays by up to 10% compared with Mondays, Thursdays and Fridays.

“I expect business to continue to come back, but it’s going to trail the restoration of leisure here for a while,” Southwest CEO Bob Jordan said on an earnings call last week.

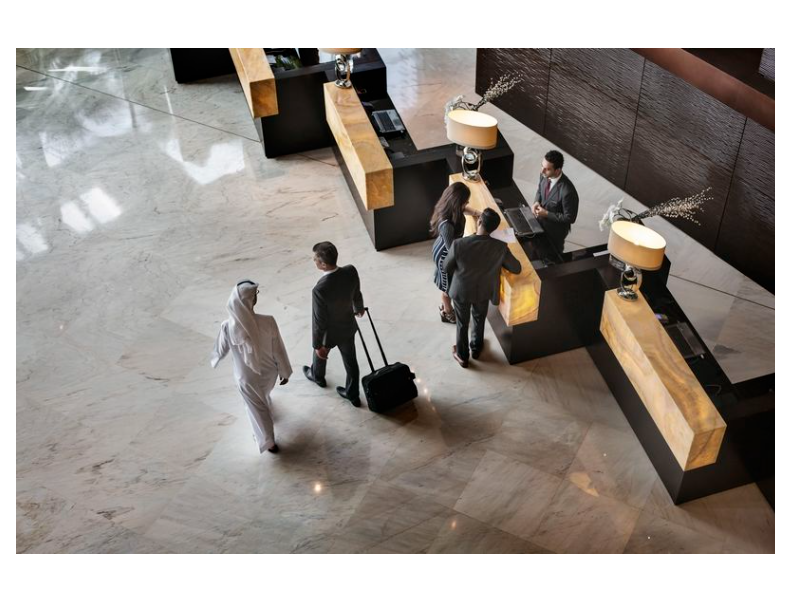

Hotels are also grappling with weak corporate demand. Marriott on Tuesday said US bookings from technology and accounting firms are still down significantly compared with 2019 levels, and room bookings by large companies are recovering more slowly.

Corporate travel’s recovery has been led by countries in Asia-Pacific and Europe, where more people returned to offices, compared with countries like the US where companies are more amenable to remote-work arrangements, according to a MasterCard report on business travel trends.

Shift in travel patterns

Airline executives say hybrid work arrangements are allowing people to combine business and leisure trips, helping carriers fill high-margin seats previously booked by corporate travelers.

Delta Air Lines said revenue growth from premium cabins has been outpacing that from low-cost seats since the pandemic. American Airlines is generating higher revenue from customers combining business and leisure, prompting it to reset the terms of its contract with big corporate customers.

But some investors are skeptical that consumers can continue to travel at the same blistering pace. Recent passenger screening and fare data shows US travel demand has peaked, hurting the carriers’ pricing power. The NYSE Arca Airline index has lost about 10% in the current quarter compared with a gain of about 3% in the S&P 500 index.

Valuations for travel companies remain below historical levels which reflects investor uncertainty beyond the summer, said Kevin Kopelman, an analyst covering hotels and online travel at Cowen.

Some executives expect corporate travel to gather steam in September. Luis Gallego, CEO of British Airways owner IAG , last week said corporate traffic was showing “some signs of recovery” in the third quarter.

Companies such as Alphabet’s Google, JPMorgan Chase, Goldman Sachs and Morgan Stanley have been pushing employees to return to offices.

But as companies hold down costs in an uncertain macroeconomic environment, a full business travel recovery in 2023 and beyond is at risk, MasterCard said in its annual travel report.

Source link