[ad_1]

The global aircraft market is facing a challenging situation due to manufacturing issues in engines and aircraft across various Original Equipment Manufacturers (OEMs). According to ICICI Securities, it is anticipated that the recovery in aircraft supply will be delayed due to fresh issues being discussed in both Boeing and Airbus.

In the past, the aircraft supply models have not been very effective for India due to OEM issues and weak airline balance sheets, which has led to a nearly stagnant fleet of around 650-700 aircraft in India for the last four years. Despite any seasonal weakness, ICICI Securities believes that the supply shortage will help profitability, and it remains their investment thesis on InterGlobe Aviation (IndiGo).

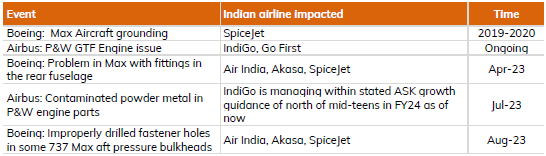

Although aircraft technical problems have become more manageable, the grounding of B737 Max worldwide and other incremental issues have led to challenges for Boeing, such as fittings in aft fuselage and improperly drilled fastener holes in a component that helps maintain cabin pressure. For Airbus, there have been P&W GTF engine problems, followed by a fresh inspection of contaminated powder metal in some of the engines.

The impact of these issues will continue to affect deliveries and postpone planned delivery schedules, as indicated by all OEMs, including Boeing, Airbus, and Embraer.

One possible angle to consider regarding these aircraft issues is the excessive outsourcing and cost management towards aeroplane part manufacturers and the relative merits/demerits of vertical or spread-out supply chains. Such debates could shed light on the structural aspects of the current problems in the aircraft market.

Source link